Managing the new class of emerging risks requires infusing the principles of resiliency and efficient risk analytics into traditional risk management frameworks.

Overview of emerging risks

In our first blog, Credit Risk Reloaded for a Modern World, we introduced Efficient Risk Analytics (ERA) as a framework that is ideally suited to tackle the challenges of managing risk within an institution. And while over the last decade financial entities have focused on risks originating within the organization, they now focus more and more on external risks that are complex to respond to and have multi-faceted impacts. One of these emerging risks is cloud concentration risk – a risk European and U.S. regulatory bodies believe could introduce systemic risk into the financial system.

Regulatory guidelines require boosting operational resilience – a preparedness exercise that places high demands on risk data capture, analytics, cloud architectures, and concentration risk exercises – a complex undertaking. The risk associated with customer data security is also expanding. Governments are implementing cross-border data residency firewalls that hamper day-to-day operations for multi-national institutions. Data security is also an emerging risk for regulators in the context of Open Finance. Finally, there is climate risk and the promotion of climate risk reporting, which places material demands on data sourcing and complex analytics to create attested financial impact reporting. But if governing bodies get serious about climate risk impacts, what data will financial institutions need to evaluate the impacts to their customers and operations? What analytics are required to produce key metrics that impact financials? What happens when these risks impact an institution’s partners and third parties? How must operating models flex to better manage emerging risks?

“It’s time, in our view, for risk functions to step up their game. Risk teams should be putting emerging risks higher up the awareness and action spectrum.”

-- Forbes, May 2021

New risks are emerging with greater frequency and pose high potential transversal impacts to institutions. Siloed approaches to analyzing and managing these risks will certainly leave institutions vulnerable. A better and more resilient approach is needed to design and enable effective risk analytics that can face up to the speed, complexity, and interconnectedness of emerging risks.

Incorporating Resiliency into Bank Balance Sheet Risk Management (e.g., interest rate risk)

It’s important to make the distinction that we are using the term resiliency in association with analytic methods that enhance the robustness of risk analyses, such as scenario-based analyses. The ERA framework, in comparison, is the organizing architecture that informs how data is sourced and organized, and how models are executed. Combining these two concepts presents a very powerful way to tackle emerging risks because they increase the effectiveness of response to risks. Let’s illustrate how this can be done for interest rate risk management.

Banks employ relatively static methods to manage the duration gap between assets and liabilities resulting from interest rate changes. Regulators require banks to analyze the impact of a prescribed set of hypothetical shocks that do not reflect how interest rates actually move to the yield curve. The shortcoming of this analysis is the singular connection with the environment – which is precisely where most of the emerging risks are originating! Interest rates are a primary but not the only factor influencing the balance sheet.

Enter Efficient Risk Analytics

What if we could expand the analysis to include a broader set of business environmental drivers beyond interest rates? What if we applied a distribution approach to estimating probability of risk events and severities? Most assuredly, these analytic methods would yield a response that is more informative than today’s discrete, point-in-time approaches to risk analytics.

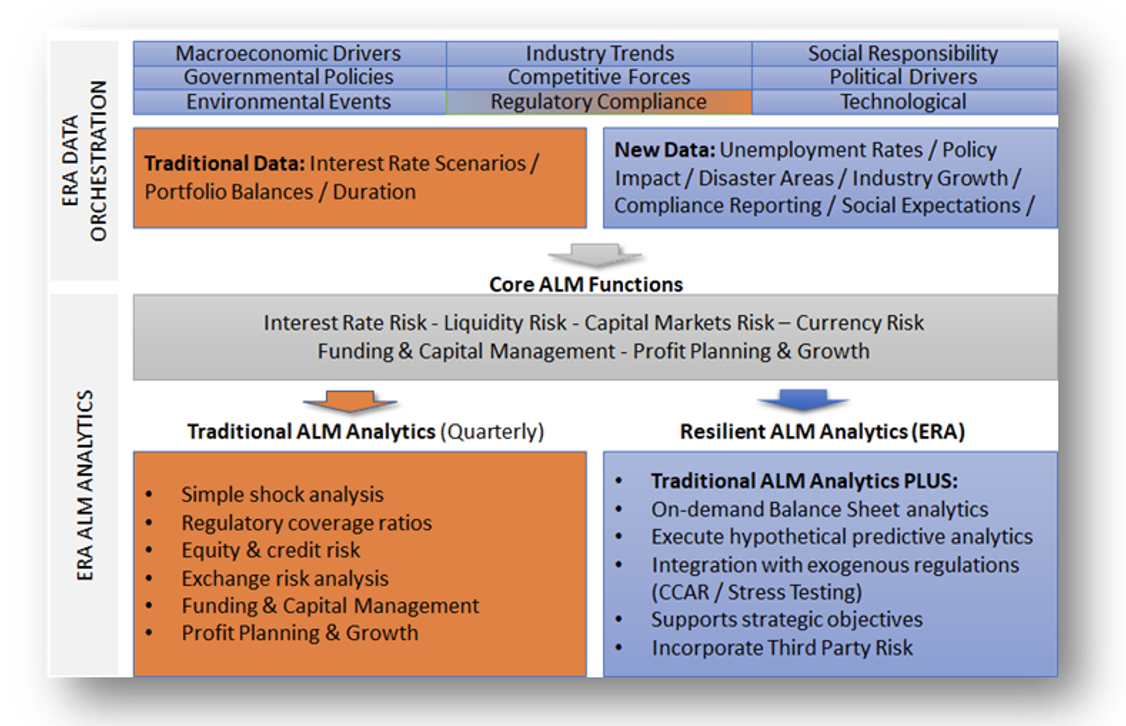

The schematic below presents an illustrative model that broadens the ALM (asset liability management) function to include other drivers. In this model, ERA enables the orchestration (i.e., the sourcing) of an expanded set of data that is supports both traditional interest rate risk analytics and advanced resilient analytics. In practice, for example, new data capturing regional climate changes can be used as a driver to changes in borrowing, loan defaults or workouts, repayment, liquidity positions and others that directly impact the balance sheet.

Illustrative Model: Resilient ALM Function

The key benefits of ERA-enabled resilient analytics rest in the meaningful linkage it creates to external drivers and the speed imperative essential for risk analytics to be performed. Risk platforms that are capable of processing computationally intensive workloads within hours, not days or weeks, and that model an entire institution’s products, will be critical.

Efficient Risk Analytics – A Setup for Value Creation

Unlike most internal risks, emerging external risks are characterized both by their high-impact on institutions and higher-frequencies – i.e., they have a ‘fatter-than-usual’ tail profile. And while they can’t be wished away, institutions can use the current environment as a motivation for adopting efficient risk analytics to minimize impacts. But beyond optimizing a response or limiting impacts, institutions will want look at the upside of investing in the approach to create business value – and that’s the focus of our next and final blog in this series.