An organization’s potential for value-creation lies in its ability to embrace the intricate relationship and co-existence between risk and opportunity and activate this through data-led transformation

Rethinking Risk and Value

Risk-taking lies at the heart of most value-creating undertakings. The inherent relationship is captured by the Chinese symbol for risk, which is made up of two separate symbols for the words, “danger” and “opportunity.” Here, our combined notion of risk and value are in line with this interpretation.

Our way of thinking about risk(s) isolates concepts that philosophers always knew were largely inseparable. Therefore, many risk management methodologies fail organizations. The frameworks we use to characterize risks – everything from ‘root cause analysis’, ‘annual top 10 risk lists’, ‘high impact / low frequency’, and exposure analyses, are disconnected from value creation.

Philosophy and etymology aside, organizations are learning, especially in financial services, to recognize the inextricable and balanced co-existence that risk and value creation share. Just think about a home loan for a moment – banks take on the risk of lending a sizeable amount of money over a period of time in exchange for the opportunity to receive substantial gains in the cost of that money lent, in interest and fees.

As discussed in the prior blog, “Emerging Risks are Systemic”, risks today are highly complex, transversal, and inter-related. It’s essential that we recognize the opportunity side to gain a sense of balance in how we analyze risks. Some risks pose existential hazards to firms and require direct board involvement. Covid-19, as a case in point, certainly validated several value-creation opportunities for organizations ranging from cost-savings in expense reduction resulting from work-from-home operations, increased use of low-cost digital channels for financial transactions, and the viability of telehealth services in the health provider sector.

Changing the Perception of Risk

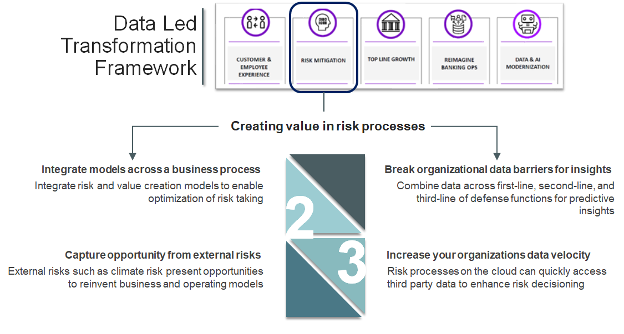

The perception of risk needs to evolve if organizations are to manage risks effectively as part of their value creation process, really from the moment of customer onboarding in a purposive design with expected journey analytics. Risk-taking versus value creation should be the strategic mantra. Risk-taking is better understood as a graduated rather than binary approach to business value creation, enabling concepts such as risk-based pricing and really the calibration of any outcome to risks assumed. And risk-taking should be accompanied by proactive management. Robust data strategy is the bridge that can create linkages between risks and opportunities, and their integration reveals the intimate relationship that exists between risk taking and value creation potential. The most exciting part about this is that today, business is equipped with vast amounts of data and the evolution of ingenious analytic and computational methods that can help optimize on value creation while evaluating risk taking in the present and future time horizons. Institutions are now racing to invest in Data Led Transformations to light the way forward. Let’s explore the inextricable relationship between risk and value, shall we?

How does risk create value? How does risk create opportunities and value today?

The following two examples of processes in financial services illustrate how risk and value coexist: 1) Risk Appetite Statements, and 2) Customer Attrition/Retention. Both functions highlight value creation at lower and higher levels in an organization, beginning with the board of directors.

Risk appetite statements such as the OCC Enterprise Risk Appetite Statement are a governance mechanism for organizations to explicitly state levels of acceptable tolerance for risk assumed. Tolerance setting helps organizations manage to acceptable levels of volatility and specific risk exposures.

Value: Avoiding unexpected risk exposures and losses in the value creation process

Financial Institutions seek to limit the risk of customer attrition in favor of retention. Yet, contrasting approaches can be found in South African and Australian banking organizations, for example, that take a ‘long term’ perspective on customers because of their relatively small addressable markets. One bank’s lost customer may be another one’s potential gain. In this environment, even defaulting customers might be prized – because keeping a customer is more profitable than the cost of replacing one. In this case, potential credit losses have been countered by the value proposition to the bank of keeping a customer with lifetime value.

Value: Long term customer retention and profitability return

Risk Data Led Transformation at the Heart of Value Creation

Access to broad risk data is a key to integrating risk and value. The faster and more accessible to users at the enterprise level and the more expansive the data tapped, the more materially significant are the opportunities to identify use cases that help an organization execute a risk-data led transformation. Our Efficient Risk Analytics framework, introduced in our first blog, "Credit Risk Reloaded" for a Modern World, prioritizes data orchestration as a foundational pre-requisite for any organization aspiring to modernize risk management.

Conclusion

The only thing to fear in risk calculations is their zero-sum separation from potential value creation. We’ve illustrated with very physical examples that risk-taking and value creation co-exist. When this concept is embraced within the framework of a data-led transformation, organizations can unlock opportunities to drive positive innovation in risk processes as shown in the schematic above. Whether organizations need to tool up for either credit risk or the global instability that often introduces emerging risks, or there is a need to generate greater business value growth from risk-taking, we have described here the criticality of risk data and applied analytics as the common current that runs through it all.